The newly introduced First Home Buyer Choice is designed to ease the financial burden for first home buyers in NSW.

From January 2023, first home buyers have the choice of paying a smaller annual property tax instead of a lump sum stamp duty at the time of purchase.

The scheme covers properties worth up to $1.5 million and only applies to first home buyers.

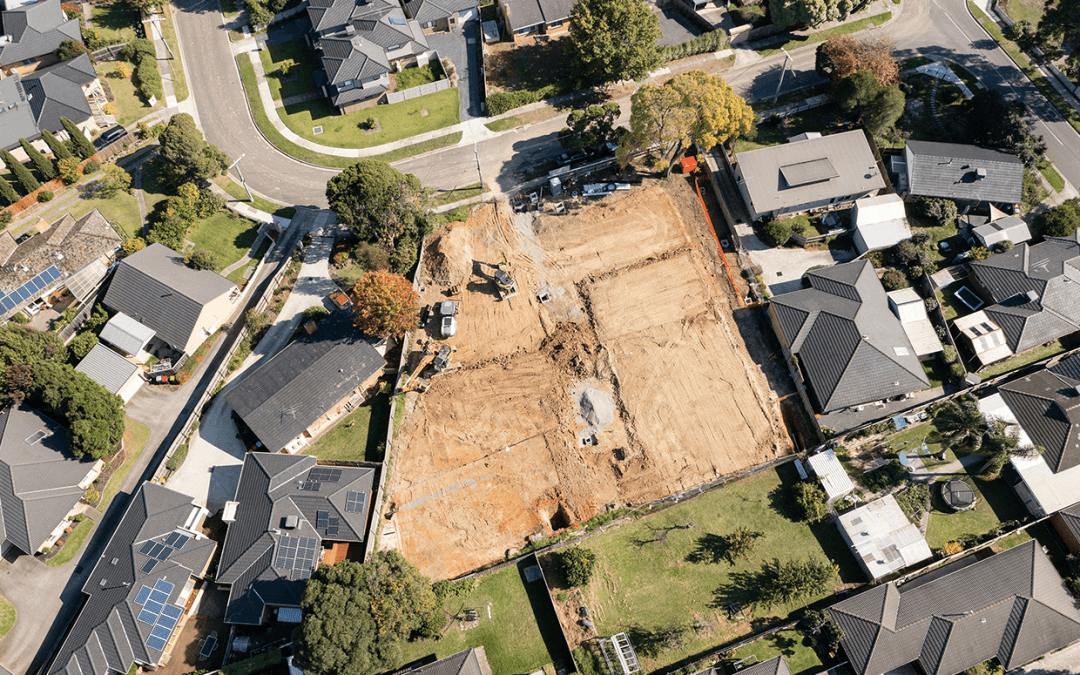

If you are buying vacant land with the intention of building your first home, the value of the land must not exceed $800,000 to remain eligible under the scheme.

The Kurmond team is happy to discuss how the new scheme can help you if you are a first home buyer building a new home.

With the financial saving that first home buyers will enjoy, the NSW Government suggests that the new scheme will help people buy a home two years earlier than previous.

It is envisioned that the vast majority of first home buyers will opt for the new annual land tax rather than pay stamp duty upfront. Currently, in NSW, first-time buyers are already exempt from paying stamp duty on homes up to $650,000.

Under the scheme, a home owner will pay $400 plus 0.3 per cent of the land value each year. Home buyers may eventually pay more than the cost of stamp duty. However, the advantage is that the upfront cost is reduced, helping them buy a new home sooner.

The NSW Government is considering extending the land tax scheme beyond first home buyers, which will help those who are deterred from buying property by the high cost of stamp duty.

If you are a first home buyer, Kurmond Homes can provide advice about the scheme if you are considering buying land with the intention of building a home.

Building a new home is a big commitment, and it’s good to have an experienced, reliable team, such as Kurmond on your side. Our objective is always to make building a new home a smooth and pain-free process for our valued customers. To discover more about building your dream home with Kurmond Homes, please contact us today or visit one of our display homes.